Contact Details

What are the contact details of your teams?

- For payments & official receipts (reminders, proofs of payment, acknowledgement receipts, requests for Statement of Account, etc.), please email billingandcollection@citiglobal.com.ph

- For documents & requirements, please email documentation@citiglobal.com.ph

- For inquiries on balance payment options and special requests, please email customercare@citiglobal.com.ph

- For questions regarding the unit and project turnover, you may contact your Marketing Partner.

What is CitiGlobal’s office address?

-

CitiGlobal Realty & Development, Inc.

12th floor Unit 5, One Executive Building, West Avenue (Delta), Quezon City

Open hours: 9AM – 5PM

Reservation Requirements and Procedures

blank

What is the process of unit reservation?

-

Upon reservation of your chosen unit, you will receive a welcome letter from the Accounting Department. To complete your unit’s reservation transaction, you must submit the following six (6) primary documents along with a few other requirements to the Accounting Department’s s email address (documentation@citiglobal.com.ph) within seven (7) days from reservation date:

- Signed Buyer’s Information Sheet (BIS)

- Signed Finishing Package

- Signed Chosen Computation

- Signed Reservation Application Form

- Signed Guidelines

- Signed Annex

What are the additional requirements needed to reserve a unit?

-

INDIVIDUALS

➢ Photocopy of Tax Identification No. (TIN) or Filled-out BIR Form1904 with Photocopy of any valid ID

➢ Photocopy of (1) Passport and (2) Any Other Government issued ID

➢ Proof of Billing Indicating Address (must be the latest billing statement)

➢ Proof of Civil Status

➢ Notarized / consularized Special Power of Attorney (SPA) if residing overseasCORPORATION

➢ Photocopies of Two (2) Government Issued IDs of the authorized representative. with marginal signatures

➢ Board Resolution/Secretary’s Certificate authorizing the Corporation to acquire real property and authorizing the company representative as signatory, among others

➢ SEC Certificate of Registration

➢ Latest GIS, Articles of Incorporation and By-Laws

➢ Post-dated checks covering the monthly amortizationsKeep in mind that:

To complete your reservation, the foregoing requirements must be submitted along with the primary documents. All requirements and payments must be completed within thirty (30) days from the date of reservation payment. Otherwise, your reservation will be deemed cancelled.

Additional Reservation Payment Guidelines

- No proof of payment, no considered payment.

- The date indicated in the proof of payment is the official due date of succeeding payments.

- The date the cash payment / credit card transaction proof has been received by the Accounting Department is the official date of payment

Payment Guidelines

blank

What are your payment options?

-

1. POST-DATED CHECKS (PDCs)

Here is a step-by-step process:

- Open a checking account with a Philippine / International Bank (only Filipino citizens are allowed to open PH bank accounts)

*you may visit a PH bank’s branch near you

*you may ask a friend / relative to open an account for you in the PH

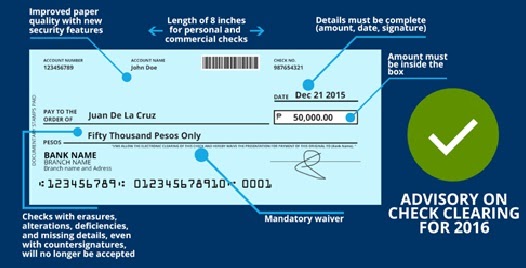

*you may have the account named under a friend / relative in the PH - Fill out post-dated checks (no erasures / alterations) for at least 36 months worth of initial payments

*for PH bank accounts, date input should be on or before monthly due date (you may check your Annex-A for reference)

*for international bank accounts, date input should be at least 20 days before your monthly due date (to allow time for clearing) - Ship your PDCs to our office:

Billing & Collection Department, CitiGlobal Realty & Development, Inc. 12th floor unit 5, The One Executive Building, West Avenue, Quezon City 1104 - Anticipate an acknowledgment receipt to be handed over if PDC’s are submitted personally, or sent via email if PDC’s are shipped via courier.

Please be mindful of: insufficient funds, unauthorized sign, alterations, counter-signed erasures, smudges that cause your checks to bounce are strictly not allowed. These may result in a Php 1,500.00 penalty, aside from the charges that will be imposed by your bank. Please keep in mind that this will reflect permanently on your credit records.

Use blue / black pens only

When writing the date, indicate the NAME of the month, and don’t write in numerical format. (Ex. ‘November 15, 2016’ instead of ‘11/15/2016’)

I don’t have a checking account yet. Do you offer any assistance?

Yes, we can assist you on opening a checking account with our partner banks below:

BDO – HEROES HILLS BRANCH

You must secure first an Endorsement Letter from Citi Global Finance Department before account opening. (Your Marketing Partner/Agent will help you with regard to this Letter.)

For a Corporate Checking Account with passbook, Php 50,000.00 is the initial deposit requirement.

For a Personal Checking Account with passbook, Php 25,000.00 is the initial deposit requirement.

You may also call BDO-Heroes Hills for more detailed information about the requirements needed for opening a checking account at (02) 372-4919 & (02) 372-4916.PS BANK – Any Branch Nearest to the client

You must provide our Billing & Collection Team (billingandcollection@citiglobal.com.ph) the ff. Details:

Complete Name

Address

Valid Contact Number

Date of Birth

Name of Spouse (if applicable)

PSBank branch where the account will be opened at least three (3) days ahead of planned account opening for Bank Validation and inter-branch approval.

Please keep in mind that opening a Checking Account requires a Php 30,000.00 Initial DepositHow do I know if my check was returned or bounced? Can the bounced check be redeposited?

Our Billing and Collection Team (billingandcollection@citiglobal.com.ph, billingandcollection2@citiglobal.com.ph) will send you an email notification regarding any returned/bounced checks asking whether it is for redeposit or if it will be paid via another mode of payment, to which you need to respond to immediately.

Please keep in mind that there will be a Php 1,500.00 penalty fee for every bounced/returned check.

How do I pull out my checks?

- To process your request, you must send us (billingandcollection@citiglobal.com.ph) an email stating your reasons and indicating the details of the check/s that you wish to pull out. Kindly send it at least two (2) weeks before the due date of your check.

- A Php 500.00 fee per check shall be automatically deducted to your account and will be reflected in your Statement of Account.

- If you will pull out more than one check, you must send us replacement checks within one (1) month from the date pulled out. Checks (which are due in less than 1 month) can be paid through other modes of payment in the meantime.

2. REMITTANCE

In order to promptly and properly monitor your remittances, CitiGlobal Realty and Development Inc. has made arrangement with banks in facilitating remittances with the following procedure:

Go to your nearest remittance center / overseas bank.

Fill-out remittance slip form / remittance application / reference number.

Ask for a breakdown of all other charges (inter-bank charges and fees) and pay them on top of your amount due. Keep in mind that CitiGlobal shall only record the amount reflected in our bank account.

We prefer for you to send the payment to our Unionbank Dollar Account as we receive daily reports of transactions which allow us to track your payments easily.

Send a copy of proof of payment on Payment Portal http://bit.ly/cgpaymentsformNote: Expect a $10 standard charge if you pay to our Unionbank account. There might be other charges by other intermediary banks, as well (which vary). Hence, we strongly advise to always make an allowance when sending your payments. Any excess amounts will be credited to your balance.

3. BANK DEPOSIT

Option 1: BDO / BPI / PNB

- Go to your nearest BDO/BPI/PNB branch

- Fill-out a deposit slip for BDO/BPI/PNB

Send a copy of your proof of payment to our portal: http://bit.ly/cgpaymentsform

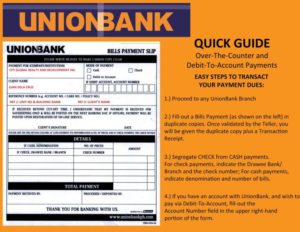

Option 2: UnionBank

- Go to your nearest UnionBank branch

- Fill-out a bills payment slip for CitiGlobal Realty & Development, Inc., see quick guide below:

3. Send a copy of your proof of payment to our portal: http://bit.ly/cgpaymentsform

4. DEBIT/CREDIT CARD

Option 1: Aqwire Portal

Go to https://realestate.aqwire.io/citiglobal

Click Pay with PH-issued card or Pay with international card.

Fill out the data needed up until the payment confirmation page.

Wait to receive an email copy of your transaction.Note:

Please keep in mind that Aqwire charges tiered fees ranging from $2.99 – $19.99, depending on the size of the transaction.

Watch a tutorial on how to fill up Aqwire here.

You need not send a copy of your card payment receipt through our portal.Option 2: PesoPay Portal

Go to our CitiGlobal direct link here.

Fill out the data needed up until the payment confirmation page.

Wait to receive an email copy of your transaction.

Take a screenshot of the email and send a copy of your proof of payment to our portal: http://bit.ly/cgpaymentsformNote:

There is a fixed fee of 3.75% charged for monthly payments made through PesoPay, so clients must make an overpayment to cover the charge.

How to compute for monthly – 3.75% charge:

(AMOUNT PAYABLE / .9625)

(Example: 10,300 / .9625 = P 10,701 is the INPUT AMOUNT)

Charges = P401

There is no need to compute for the credit card charge. The system will provide for your convenience. Just indicate the amount you are going to pay.5. AUTO-DEBIT / AUTO-CREDIT

Go to https://realestate.aqwire.io/citiglobal and enroll in the auto debit feature of Aqwire.

Note:

Please keep in mind that Aqwire charges tiered fees ranging from $2.99 – $19.99, depending on the size of the transaction.

Watch a tutorial on how to fill up Aqwire here.6. FUND TRANSFER OR ONLINE BANKING

Option 1: UnionBank Online Bills Payment

- If you have a UnionBank account, you may easily pay your amortization to our UnionBank account via Bills Payment thru:

Online transfer (via mobile app) or

Any UnionBank ATM machine where you can easily find CitiGlobal in the options given and choose as your beneficiary - Send a copy of your proof of payment to our portal on http://bit.ly/cgpaymentsform

*If you don’t have a UnionBank Account yet, you may open a UnionBank EON Account Online to avoid the hassle of going to a remittance center to make a payment. Simply tap on your mobile phone to send your monthly payments. EON Accounts have ZERO maintaining balance. In order to load your account, you may:

*Ask a relative to fund it for you by depositing to your account.

*Send a one-time remittance payment to Unionbank to fund the account.

For more information and a step-by-step guide, please see click the link below: EON Account Opening.

Option 2: Online Transfer to BDO / BPI / PNB

Go to your online banking app

Transfer your payment to any of our bank accounts here

Send a copy of your proof of payment to our portal: http://bit.ly/cgpaymentsform - Open a checking account with a Philippine / International Bank (only Filipino citizens are allowed to open PH bank accounts)

Where do I send my Proof of Payment (POP)?

-

Starting September 16, 2018, all Monthly Amortization proof of payments, such as deposit slips, remittance forms, fund transfer receipt, online banking, etc., must be sent to CitiGlobal’s collection team through the payment portal link: http://bit.ly/cgpaymentsform. Should you encounter any issues with the portal, you may send it via email to billingandcollection@citiglobal.com.ph.

Upon filling out the form, you will arrive at a confirmation page, which states that your entry has been successfully received. Please refrain from duplicating your entry to avoid confusion in cross-checking transactions, which may lengthen the processing time.

Do you have a grace period for late payments?

- A three (3) day grace period shall be observed after the due date of every monthly amortization or Lump sum payment schedule. However, the grace period shall no longer apply if you have already received a NOTARIZED NOTICE OF CANCELLATION AND FORFEITURE

When will I receive my copy of the Official Receipt?

-

In order to release the Official Receipt for reservation, the ff. must be submitted:

- Reservation Form

- Unit Owners Guidelines

- Unit Finishing Package

- Buyers Information Sheet

- Payment Terms

- Annex-A

- Full reservation payment

Scanned copies of the Official Receipts (ORs) of subsequent payments shall be sent through email within two (2) months from the time we receive your payment receipt.

Where can I request for a payment breakdown or Statement of Account?

- The Collection Team shall send you a Statement of Account along with your Official Receipt.

You may also request for a breakdown of past payments / Statement of Account directly from our Collection Team by emailing billingandcollection@citiglobal.com.ph and CC your Marketing Partner/Agent.

How can I claim my Original Receipts?

In order to claim Original Copies, the principal buyer may:

- Personally visit the office (in which they must make a notice 2weeks prior to visitation), or

- Have an authorized representative claim them.

The following must be presented when receiving the OR:

- Principal Buyer

*Valid ID - Authorized Representative

*Valid ID of the authorized representative

*Special Power of Attorney

*Photocopy of the Principal Buyer’s valid ID

*Special Power of Attorney must be consularized or notarized (original)

Why do I have penalties?

-

The following are the common reasons why your account has a penalty:

- You failed to settle your monthly amortization or lump sum on or before your due date.

- Returned checks or bounced checks. (Php 1,500.00 will be charged on every bounced/returned check)

- Failure to submit your proof of payment on time, even if you have paid at the bank before or on your due date, will be considered a delayed payment.

*Note: No proof of payment, no payment.

How much is the penalty?

The following are the penalties imposed on late or non-payment of monthly amortizations:

DAYS PAST DUE

1-30 DAYS

PENALTY RATE

3% compounded monthly

Please keep in mind that CitiGlobal will not be responsible for late payments due to:

- Sending to an incorrect email address

- Failure to send the proof of payment on / before the due date

- Not knowing your current amount due (as stated in the Contribution Record sent to you monthly, along with your Official Receipt)

What will happen if I make an overpayment?

- The excess payment will be credited to the next amortization. For example: You pay a Php 12,500.00 instead of Php 12,300.00 on your February amortization, the Php 200.00 excess payment will be deducted from the next month’s (March) due.

Balance Payments (Financing Options)

blank

Who will I contact regarding my options for balance payments after DP?

- Your remaining balance is payable through Bank Financing / In-house Financing / Cash Payments. All balance payment-related concerns must be relayed to customercare@citiglobal.com.ph.

Bank Financing

blank

How much is the interest for bank financing?

Interest is usually between 6-9% per annum (per year) depending on the assessment of the bank.

What are the requirements for bank financing?

We can assist you to apply with our accredited bank partners. However, you need to submit the complete bank requirements for us to process your loan.

Eligibility Requirements:

Filipino Citizen, Dual citizen with oath of allegiance or Foreigner.

At least 21 years old but not exceeding 65 years old upon loan maturity.

Stable source of income from employment or business.

For foreigners:

Married to a Filipino, or

Resident of the Philippines in the last three (3) years or

With qualified Filipino citizens co-borrower with regular income.

Subject to bank credit evaluation and other documentary requirements.

Basic Requirements:

Properly filled out Bank Application Form

Original copy of certificate of No Marriage (CENOMAR), If single or copy of Marriage Contract, if married.

Proof of Income

3 Months Latest Payslip

Special Power of Attorney (if borrower is working or residing abroad).

In-House Financing

Once all requirements have been submitted to the Accounting Department, they will endorse your documents and all other necessary requirements for In-house Financing.

blank

How much is the interest for in-house financing?

- Interest ranges between 10-14% per annum, for 3-10 years.

What are the requirements for In-house Financing?

-

Primary Documents (please see attached)

- Fully filled-out In-House Application Form.

- Attorney in Fact Information Sheet, if applicable.

- Notarized or Consularized In-House Financing Special Power of Attorney, as the case may be.

Additional Income Documents

- Three (3) Months Latest Pay Slip

- Three (3) Months Latest Bank Statement or Income Tax Return (ITR)

Additional Required Documents

- Signed Annex A or Breakdown of In-House Financing Terms. Please see attached.

- Signed Client Declaration. Please see attached.

Until when we have to submit the necessary documents?

- You must submit the needed requirements within 14 days upon confirming your preferred payment option.

Procedures on Amendments in Documents

blank

Can I sell my unit?

-

You may sell or assign your rights over the subject property during the life of the contract under the following conditions:

- The subject property/unit is not yet due for cancellation or no pending cancellation notice and forfeiture is at hand.

- Notarized Deed of Assignment and notarized Deed of Acknowledgement must be submitted to CitiGlobal prior to assignment of rights by the former buyer/client to the new one.

- The new buyer/client is willing to pay a determined amount of transfer fee of PhP 75,000.00 for TCRS Units and One Hundred Thousand Pesos PhP 100,000.00 for DBR Units. A new reservation payment of PhP 25,000.00 for TCRS and PhP 50,000.00 for DBR is also required.

What are the requirements and procedures of transfer of ownership?

-

The following are the primary requirements to process your request for transfer or assignment of rights over the purchased property, after the reservation documents have been signed:

-

Written requests must be submitted to CitiGlobal for account assessment.

-

Accounts with unpaid penalties / delayed payments shall not be allowed for Change of Name or Transfer of Ownership. They must be settled prior to processing.

-

Only the Principal Buyer can request for Change of Name or Transfer of Ownership;

Below is the procedure on how to process your request for transfer or assignment of rights over the property:

- Send a letter of intent to documentation@citiglobal.com.ph and cc customercare@citiglobal.com.ph including the following information:

*name, contact number, email address, complete address including country of residence of the new owner;

*unit, building and project intended to be transfered;

*all obligations to be shouldered by the new owner henceforth; and

*signature of the old buyer - The letter of intent is subject to approval by the management.

- An original notarized Deed of Assignment and Deed of Acceptance must be submitted by the transferor (Consularized if SPA is executed outside the Philippines);

- New buyer(s) must submit primary and secondary documents.

- Upon approval, the client has to pay a transfer/processing fee of Php 75,000.00 for TCRS units and Php 100,000.00 for DBR units, and new reservation fee amounting to Php 25,000.00 (TCRS), Php 50,000.00 (DBR) will be shouldered by the transferee.

Note: Transfer of Unit is not allowed when it has already been turned-over or has been fully paid.

- Send a letter of intent to documentation@citiglobal.com.ph and cc customercare@citiglobal.com.ph including the following information:

Change of Personal Information or Contact Details

-

Can I change my personal information or contact details?

Yes. You can change your personal information or contact details.

How can I change my personal information or contact details?

Simply email the Documentations Team (documentation@citiglobal.com.ph) and cc your marketing partner (agent) of the ff.:

- Change of Marital Status to Married

*Original Change of Status Letter addressed to the Accounting Department

*Proof of Marriage

*Revised Buyer’s Information Sheet

*Photocopy of spouse’s (2) valid Government-Issued ID2. Change of Billing Address

*Notice of Change addressed to the Accounting Department

*Proof of New Billing Address3. Change of Contact Information

*Notice of Change addressed to the Accounting Department

Contract to Sell

blank

What is a Contract to Sell?

-

A Contract to Sell refers to a notarized agreement between a seller and a buyer. The contract shows that the seller (CitiGlobal) promises to sell something to the buyer (Client) and the buyer also promises the seller to buy the property. It is like an expanded version of your Reservation Application Form.

This is a legal document that will serve as an agreement between Citi Global and the buyer.

How long does it take to draft, notarized and release the Contract to sell?

- The client must have already paid at least 1 month of the monthly amortization as agreed during reservation;

- Once all the requirements & updated information are transmitted to CGRDI, CTS will now be drafted;

- After drafting, a softcopy of the CTS will be sent to client/s via email.

- Client/s will have to send back the signed CTS through their chosen courier.

- CGRDI will acknowledge receipt of client signed CTS & will advise clients that notarized copy may be claimed in the office after two

- (2) months from the date CGRDI receives the signed CTS.

- CGRDI authorized representative shall now sign the CTS;

- After the CTS has been signed, the said contract is now for notarization.

- Once the contract is notarized, CGRDI will send an email notification to the client that their CTS is ready for pick-up.

- Client may claim his original copy of the CTS at the Citiglobal office either personally or through his/her Authorized Representative if accompanied by an original notarized or consularized Special Power of Attorney.

- The whole process can take at least 2 months if the client is responsive to our requests for information.

Deed of Absolute Sale

blank

What is a Deed of Absolute Sale (DOAS)?

- A Deed of Absolute Sale is an Agreement whereby the Seller is transferring its property rights to the Buyer.. The contract shows that the property rights of the seller are now being passed on to the Buyer, and the Buyer now has full right to use the property he/she purchased.This contract is prepared after full payment by the buyer of the purchase price of the property, as well as all other underlying taxes such as Transfer Tax, Documentary Stamp Tax, and all other fees related to the transfer and registration process.

What are the requirements for drafting the Deed of Absolute Sale?

- Full Payment of the Total Contract Selling Price and Miscellaneous Fees;

- Notarized copy of the Contract to Sell;

- TIN Number

*If the client doesn’t have a TIN Number, CGRDI may process a TIN on behalf of the client. The Documentation Team will send the client an email regarding the process and fees to be paid by the client. - Photocopy of Updated IDs

*Passport / PSA Birth certificate

*Driver’s License / Other Gov’t-issued ID

Covid-Related Policies

blank

Will I incur a penalty for not paying my monthly amortization during the ECQ period?

No, you will not incur penalty if you are unable to pay during the lockdown period. We are giving a 30-day grace period to settle your unpaid balances.

I am still not able to pay my balances even after the period of ECQ. What will happen to my unit?

You may still receive a Notice for Delayed Payments that may result in cancellation of your unit. But to help you reduce your obligations, we are allowing you to exclude your dues from March 15, 2020 to May 15, 2020 (under the Bayanihan Act), from the notice and pay it within six (6) months from May 16, 2020, to October 16, 2020.

Other Concerns

blank

Can I visit the location of the project?

Yes. You may schedule a site trip with your Marketing Partner/Agent.

Please remember that you need to inform your Marketing Partner/Agent ahead of time to avoid inconvenience. Our project is ongoing therefore site visitation without a representative from Citi Global is not allowed.

How will I know the update regarding the construction and turn-over date of my unit?

You will receive monthly email updates regarding the construction of the project from customercare@citiglobal.com.ph. We also upload construction videos on our YouTube channel each month. If you do not receive our updates, kindly inform us by emailing customercare@citiglobal.com.ph immediately.

What is Miscellaneous Fee?

Beside the total contract price of the unit you purchased, there are miscellaneous fees payable to the Developer for the transfer of title from the Developer to the Buyer’s name (closing fees) and other related expenses in connection with the sale.

Miscellaneous Fees are fixed at 7.95% of the total contract price. It includes fees and charges for Documentary Stamp Tax, Transfer fees, Registration fees, Administrative and Processing fees, LGU/IT Service fees, and Utilities Application.

Clients who do not wish to pay the miscellaneous fees may process the transfer on their own.

Who do I contact if I cannot reach my Marketing Partner/Agent?

If you have issues in contacting your Marketing Partner, you may inform our Customer Care Team by emailing customercare@citiglobal.com.ph.

Get in Touch

We'd love to hear from you!